Audish: Confronting a new legal reality

The collateral-source rule, the Secondary Payor Act and Medicare in Audish v. Macias

On June 6, 2024, the Fourth District Court of Appeal delivered a striking decision in Audish v. Macias (2024) 102 Cal.App.5th 740. The case, spearheaded by my friend and fellow attorney, Omid Rejali, began as a straightforward personal-injury claim stemming from a car wreck – but quickly transformed into a battle over Medicare and future insurance eligibility. When the jury returned with a disappointing verdict, the Audish team decided to fight back.

The appeal

Central to the appeal was a contentious ruling: Audish contended that the court erred by allowing the defense attorney to ask his life-care planner about the plaintiff’s future eligibility for Medicare. Specifically, the defense questioned whether Audish would qualify for Medicare at age 65 and if the life-care planner had factored Medicare rates into her projections. This line of questioning, in many legal scholars’ opinions, violated the collateral-source rule. Indeed, Audish argued it jeopardized the integrity of his claims.

The Court of Appeal, however, upheld the trial court’s decision, permitting this “limited evidence” regarding Audish’s future Medicare eligibility. Citing Cuevas v. Contra Costa County (2017) 11 Cal.App.5th 163, the court dismissed the collateral-source rule’s application in this context. This, despite Cuevas being a medical-malpractice case where the collateral-source rule does not apply. While I strongly disagree with this interpretation and believe Audish deserved de-publication, CAOC’s de-publication request to the Supreme Court was denied. This has forced us, as plaintiffs’ attorneys, to confront a new legal reality.

A personal journey through Audish

Just a month after the Audish ruling, I found myself preparing for trial in Orange County, presided over by Judge Craig Griffin. The implications of Audish loomed large over my case, which involved a 60-year-old woman injured by a security gate. After enduring a two-level cervical facet fusion, she faced staggering future medical costs, much of which would fall under Medicare after her 65th birthday.

Determined not to be blindsided, I sought counsel from John Rice at The Lien Project. He educated me on the Secondary Payer and False Claims Acts, revealing that if a third party was liable for my client’s injuries, Medicare would be replaced as primary payer, and technically made a secondary insurer. Practically, this meant any award for future medical damages would need to be placed in a trust and used solely for medical treatment moving into the future (think Medicare set aside in settlement situations).

The strategy

To navigate the murky waters left by Audish, I crafted a plan. First, I made sure all my witnesses were familiar with Medicare; doctors typically are but it proved unlikely they knew anything about the Secondary Payer Act or False Claims Act. Second, I drafted requests for judicial notice regarding the Secondary Payer Act and the False Claims Act to file after the proverbial cat was out of the bag.

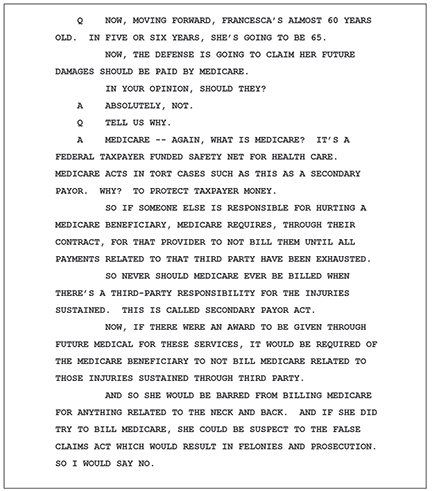

Because we saw the benefit of using our argument to polarize the case, we did not file the requests for judicial notice prematurely. Instead, I prepared our billing expert to affirmatively discuss the issues since we were nearing the end of our case-in-chief and Defendant had not brought the issue up. My thought was that they were waiting until their case to bring it up, so I had no counterargument. After some in-depth discussions, our billing expert began to understand the nuances of Medicare’s implications to bolster our case. His testimony was a revelation for the jury and a shock to the defense.

After our billing expert took the stand, I immediately filed requests for judicial notice, setting the stage to leverage the Secondary Payer Act and the False Claims Act during closing arguments. My strategy was clear: I wanted to illustrate just how far the defense would go to undermine our case. They argued our client wasn’t truly injured, that she didn’t need surgery, and that future care was unnecessary. To top it off, they would suggest that taxpayers should shoulder the financial burden for her damages, rather than the party responsible for the injury.

Even more outrageous, they wanted my client to consider billing Medicare, risking severe legal consequences, including potential felony charges. And let’s not forget the looming crisis – taxpayers might end up funding her future medical treatment in a system on the brink of collapse, with the Medicare Insurance Fund projected to run dry by 2036.

Once the defense caught wind of my strategy, it became clear they would back off these claims. In fact, during direct examination, their billing expert admitted he was not advocating for my client to treat through Medicare in the future, effectively retracting their position. The judge had even prepared a special instruction for the jury, stating: “For any damages awarded for the injuries sustained in this case, [Plaintiff] must exhaust the award prior to being able to treat through Medicare.” Ultimately, this instruction was never given to the jury because the defendants chose to withdraw their claim altogether.

Cross-examining defense experts

If, however, the Defendants continued to push the claim, I was ready. I truly believe Audish can be used as a sword in every case by the Plaintiffs’ bar, enabling attorneys to polarize the case to their extreme advantage. In addition to preparing all experts and treating physicians on the concept of the Secondary Payer Act and False Claims Act, there is a lot more we can do.

Make sure the jury knows who funds Medicare: the taxpayers. By telling the jury to reduce future damages to Medicare rates because the plaintiff will be treated through Medicare, they are in essence telling the jury and the community to pay for damages Defendants are solely responsible for. This is contrary to all com- mon sense, logic, and the law, and should create a visceral reaction from the jury.

Should defense experts claim that Medicare should be used to determine the reasonable value for the treatment that your client received, you can cross them on several hot-button issues. For example, you can simply establish your client is not currently a Medicare recipient (must be 65+, have a certain disability, be an ALS patient, or have end stage renal disease), so the numbers don’t apply to them.

Moreover, the Medicare Hospital Insurance Trust Fund will cease to operate after 2036, potentially leading to bankruptcy. By that time, Medicare will be spending $3 billion dollars more every year than the revenue it generates. This signals big changes are on the way, and not ones where the doctors get paid more for treating Medicare patients.

In fact, Medicare is currently being cut every year. Medicare rates change every year based on Congressional decisions and the taxpayer budget, which continues to shrink. Politicians like Donald Trump have threatened to cut Medicare rates entirely, and while this is unlikely, it is highly likely massive cuts in the Medicare budget will continue.

Finally, set up a cross of the defense expert with your direct examinations of the treating physicians. Ask questions like, “If you accepted Medicare for every patient, would you be able to keep a profitable business?”; “Does Medicare pay you what’s reasonable for your services?”; and “Is Medicare the lowest reimbursement rate?” Typically, you will get the answers you want, which you can parlay into a good cross-examination. If you want to see how I typically attack billing experts, check out my article in the Los Angeles Daily Journal; if you don’t have access, email me and I’m happy to send it.

Conclusion

While the Audish case introduced new challenges for plaintiff attorneys, it also sparked innovative strategies and robust discussions around future medical care costs. As we adapt to new precedents, we can transform potential setbacks into powerful arguments that resonate with juries and uphold our clients’ rights.

If you are wondering about what happened in our case, the jury found for us. They awarded in excess of $3.6 million, including nearly all of our requested future medical damages. With interest and costs stemming from an old 998 offer, they currently owe more than $4.5 million. While they have indicated they will appeal the verdict, I plan to file a cross-appeal on Audish and show the Court why it is inappropriate for juries to consider Medicare in the future.

Greyson M. Goody

Greyson Goody is a partner at Goody Law Group and the Simon Law Group. He attended Thomas Jefferson School of Law in San Diego. There he met fellow Simon Law Group attorneys Brandon Simon, Sevy Fisher, Evan Garcia, and Travis Davis as well as his wife, Taly. Greyson is a proud member of the Consumer Attorneys Association of Los Angeles, Consumer Attorneys of California, Orange County Trial Lawyers Association, and the American Board of Trial Advocates.

Copyright ©

2025

by the author.

For reprint permission, contact the publisher: Advocate Magazine