Understanding the building blocks of present value

Why economists reach different conclusions with the same methodology

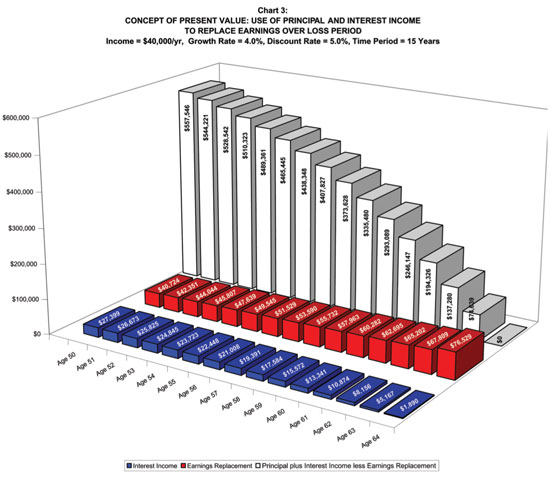

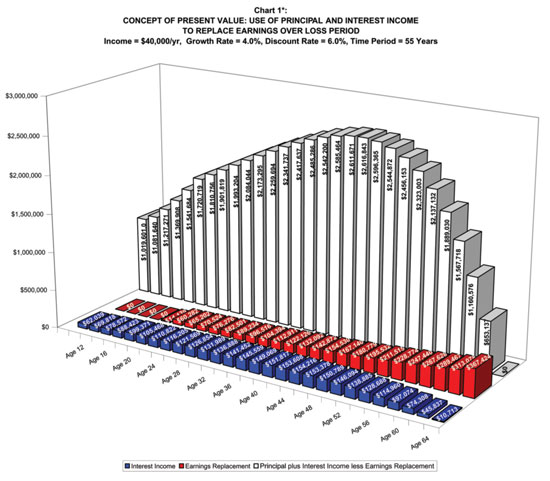

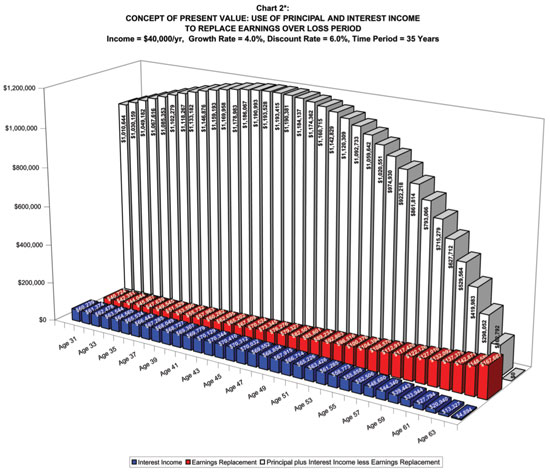

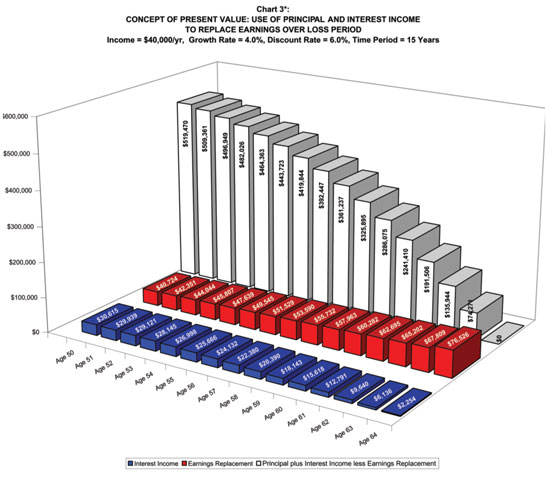

*[Ed. Note: The chapter and appendix charts are found at the end of the article. Depending on preference, either chart is useful in educating the jury about present value.]

Many personal injury cases, where the injuries suffered are permanent and significant, result in a loss of future earning capacity and future medical expenses. Awards for such losses are paid as lump sums and are required to represent the present cash value of the anticipated lost stream of future earnings and future medical expenses. The present value requirement is set forth in CACI 3904 and is as follows:

If you decide that [name of plaintiff]’s harm included future [economic] damages for [loss of earnings/future medical expenses/lost profits/[insert other damages]], then the amount of those future damages must be reduced to their present cash value. This is necessary because money received now will, through investment, grow to a larger amount in the future.

To find present cash value, you must determine the amount of money that, if reasonably invested today, will provide [name of plaintiff] with the amount of [his/her/its] future damages.

[You may consider expert testimony in determining the present cash value of future [economic] [damages.]

[You will be provided with a table to help you calculate the present cash value.]

(CACI, 3904, Thomson West, February 2008 Edition)

As required by CACI 3904, the present value sum must be sufficient to pay out lost future earnings and medical expenses equal to the amounts of those losses and at the times those losses will occur. At the end of the future time period, the amount awarded for such damages, plus the interest earned on the award, will be completely used up by making the annual payouts.

While simple in principle, experience has shown that a firm grasp of both the mechanics and economics of present value is one of the more difficult processes for attorneys and jurors to understand. Attorneys commonly retain an expert economist to both determine the present value of future economic damages and to effectively explain the present value concept to the jury. While the expert would be expected to have a full understanding of present value, it is the attorney’s duty to guide the expert through proper questioning, both on direct and cross examination, so that the jury gains an understanding of the concept and how the expert used it to determine present value. An inadequate understanding by an attorney of the present value process has the potential to leave a jury confused and unable to render a just verdict for economic damages. Moreover, it is a mistake to believe that the expert alone can solve this shortcoming. The expert is not in the position to provide a narrative or ask the questions and then answer them. The expert can only answer the questions that have been asked. The purpose of this paper is to provide attorneys with an understanding of both the mechanics and economics of the determination of present value.

The mechanics of present value

The present value process for the determination of earning capacity has four building blocks. These are:

(1) The earning capacity lost in today’s dollars;

(2) Remaining work life;

(3) Percentage growth rate for earnings; and

(4) Discount rate or interest return on invested money.

Once each of the four building blocks has been quantified, present value is a matter of arithmetic.

This article will center around three hypothetical situations commonly involved in the determination of present value of lost earning capacity in personal injury cases. The three situations are:

• Injury to a 10-year-old person;

• Injury to a 30-year-old person; and

• Injury to a 50-year-old person.

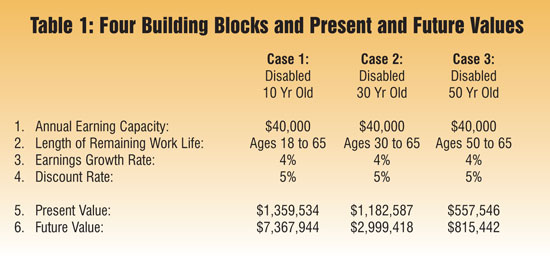

For simplicity in presentation, each example will assume an earning capacity of $40,000 per year, a worklife to age 65, an earnings increase rate of 4 percent and a discount rate of 5 percent. Table 1 shows these assumptions and the corresponding present and future values for each situation.

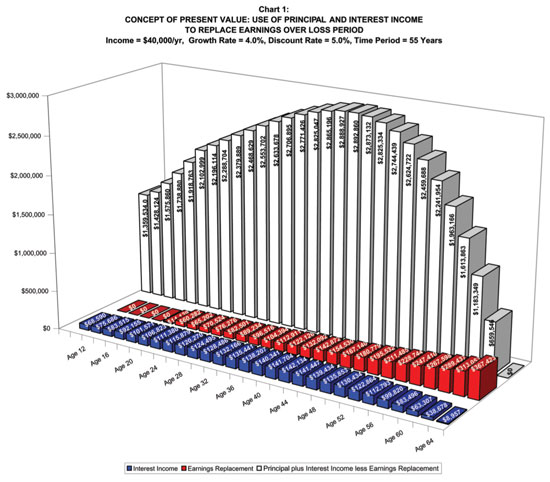

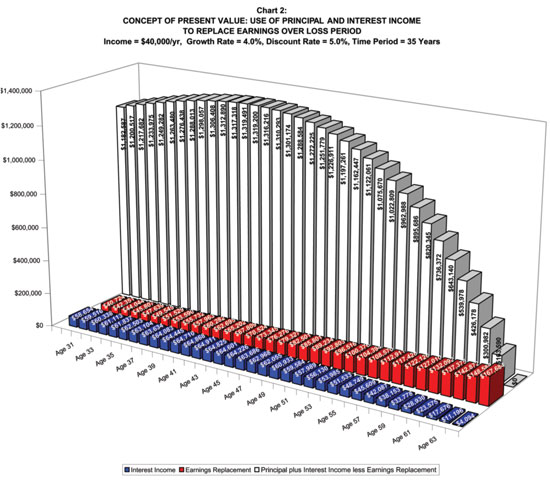

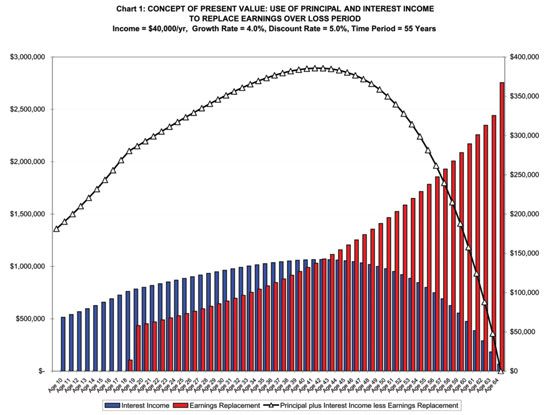

Charts 1 through 3 (following conclusion of article) depict for each situation the change from year-to-year of the principal invested, wage replacement and interest income. (For viewing purposes, every other year’s data have been omitted in Chart 1.) The bars showing principal plus investment return represent the “balance” in each of the future loss periods. The bars showing wage replacement and interest income represent annual cash “outflows” and “inflows,” respectively. In all three examples, the investment is reduced to zero by age 65. Indeed, this result is guaranteed by mathematical formula. Once each of the four factors has been quantified, there is only one present value that will replace the lost earnings in the amounts and at the times those losses would have occurred.

One may note from the charts that in the case of the 10-year-old child and 30-year-old adult, the interest income exceeds the annual wage replacement for several years. In the case of the 10-year-old, the principal investment would increase for 32 years before beginning its decline to zero, while occurring after 13 years for the 30-year-old. With regard to the 50-year-old adult, the annual interest always falls short of the amount needed to replace the earnings, requiring immediate liquidation of the investment principal by the amount of the shortfall.

Charts 1 and 2 demonstrate that the longer the future loss period measured from the present, the principal invested must grow for a longer period of time in order for there to be sufficient principal to replace the earnings near the end of the work life. An inspection of Chart 1 shows that once the earnings replacement begins, the principal invested begins to increase at ever slower rates until reaching a peak. Once it peaks, however, in both Charts 1 and 2, it begins to decline at ever greater rates until the principal goes to zero at age 65. An understanding of this process of growth and decline of principal is important because it demonstrates that in matters where the projection period is “long,” the interest income must be greater than the annual wage replacements for many years; otherwise there would be insufficient principal to replace the loss in the latter years of the loss period.

Table 1 records both the present and future values. Future value is calculated using only building blocks one through three. Therefore, the difference between present and future values is the interest income earned during the future loss period and demonstrates the extent to which interest income assists in replacement of the economic loss. As Table 1 shows, the longer the future loss period, the greater role interest income plays in the earnings replacement. In addition, for cases involving medical malpractice with a verdict in excess of $50,000, either party can elect to have future damages paid periodically. A future value analysis can be of assistance to the court when fashioning a periodic payment order.

When making projections over a long period of time, the future figures can at first glance appear unrealistic. Currently, it is hard to imagine that annual earnings of $40,000 in 2008 will increase to $158,000 in 2043, not to mention $350,000 by 2063. However, such figures simply assume a future wage growth of 4 percent, which is not unreasonable given historical wage growth. Fifty years ago, annual earnings in 2008 of $40,000 may have seemed unreasonable. It is important to remember that such increases do not occur overnight, but take place over a long period of time.

Net discount rate

The terms discount rate and interest rate are used interchangeably. However, there can be confusion between “discount rate” and “net discount rate.” The term “net discount rate” is measured as the difference between the discount rate (interest rate) and the growth rate. It is common practice today for economists to combine both the growth rate and the interest rate into a “net discount rate.” Use of a net discount rate assumes that the impact of inflation on wages and the inflation premium in the interest rate are basically the same and can be eliminated from the analysis. That way, whatever future inflation turns out to be, the present value calculated using a net discount rate will be correct.

Use of a net discount rate allows the economist to reduce the number of present value building blocks from four to three, since he can specify one net discount rate rather than a separate nominal wage growth and discount rate. In the previous examples, a net discount rate of one percent was used, equal to the difference between the four percent nominal growth rate and the five percent nominal interest rate.

Sensitivity analysis

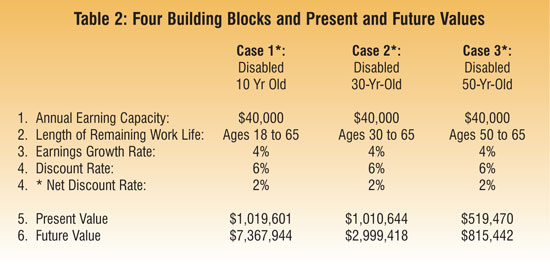

The previous case examples demonstrated how present value changed due to alternative future loss periods. To further illustrate the sensitivity of present value when one or more of the building blocks change, the present values under each of the previous case examples will be recalculated using a net discount rate of two percent, derived from using a nominal growth rate of four percent and a nominal discount rate of six percent.

The recalculations in Table 2 demonstrate how the present values change when the net discount rate (derived from the growth and discount rates) changes from one to three percent. The future values do not change since they are calculated using only building blocks one through three, and those remain unchanged in our examples.

The above figures in Table 2 show a negative relationship between present value and the net discount rate. The present values declined by $339,933 or 25 percent for the 10-year-old, $171,943 or 15 percent for the 30-year-old, and $38,076 or seven percent for the 50-year-old. The above changes demonstrate that the longer the future loss period, the greater the percentage decline in present value due to a higher net discount rate. Each case will show a greater decline in present value as the net discount rate increases further, eventually resulting in a present value under Case 1 less than that under Case 2. This occurs due to the benefit of interest accumulation under Case 1 before earnings replacement begins at age 18. As Charts 1* through 3* show, the future year that the replacement earnings begin to exceed the investment income will vary depending on the net discount rate and length of the future loss period.

Despite the net discount rate or length of future loss period, the above examples illustrate that even if the principal award initially increases by investment earnings, the growth rate for the loss claimed will eventually exceed the investment earnings, resulting in an erosion of the initial award plus interest. Whether the cash outflow for earnings replacement begins to exceed the cash inflow from investment income in year one for the 50-year-old, year 13 for the 30-year-old, or year 33 for the 10-year-old, once it does, the principal balance will begin to decline and eventually the loss claimed will consume the entire remaining award, as well as any investment income. Thus, the injured party does not receive a windfall but rather a just award, that when properly adjusted for present value, compensates only for the losses suffered.

The economics of present value

The debate between plaintiff and defense over the appropriate present value centers on the quantification of each of the four building blocks. What may appear as small modifications to the quantification of each building block can have a significant effect on present value.

With perhaps few exceptions, there is discretion over the magnitudes of each of the four parameters. Examples of the sources of discretion and the types of evidence that may assist the jury in resolving what the most reasonable values are for the four parameters are discussed below.

Earning capacity

Earning capacity is a term that refers to the ability or capacity of a person to earn money. Earning capacity may or may not be equal to the plaintiff’s actual pre-injury earnings. For example, the plaintiff may have suffered an unrelated injury, illness, layoff, or experienced some family situation which interrupted his earnings prior to the injury involved in the lawsuit. In the other direction, the plaintiff may have enjoyed considerable overtime or was assigned to a more lucrative position which may or may not have persisted in the future.

The past earnings history may be relevant, partly relevant, or irrelevant in ascertaining a reasonable measure of the plaintiff’s annual earning capacity on a going forward basis. While there may be instances where the economist can help resolve this issue, it is more likely that the attorneys, through other witnesses or documents, can provide the foundation needed to resolve this question. Testimony from the plaintiff, his employer, or physicians would reasonably shed light on the extent to which those events should be regarded as permanent or transitory.

Both plaintiff and defense attorneys should make good efforts to get the information needed to explain why the plaintiff earned what he did in his past. This information can be very useful in the determination as to the most reasonable earning capacity to attribute to the plaintiff.

Some plaintiffs have little opportunity for promotion and advancement while others have significant opportunities in that regard. Three ways of assessing this likelihood are from the employer, statistics relating age and earnings, and from vocational expert testimony. As a rough rule, for which there are many exceptions, earnings for persons across many occupations are commonly double for persons age 45 or above as compared to persons age 20 to 25 at the same point in time. This difference in earnings reflects the return to age and experience. The plaintiff, his employer or co-workers, may be able to provide some evidence on probable advancement.

Another avenue for assisting the jury to come to a reasonable measure of the plaintiff’s earning capacity is through the testimony of a vocational expert. An example might be where the plaintiff was training for or had just entered a new occupation or was a recent transplant from some other part of the country or world. These might be instances where past earnings are irrelevant to earning capacity on a going forward basis. The vocational expert can assess the employment characteristics and skills of the plaintiff and ascertain his reasonable position in the job market, including advancement as experience is gained.

A role unique to the economist in determining the plaintiff’s earning capacity from an examination of the wage history relates to placing past magnitudes in terms of current dollars. This is accomplished by adjusting past earnings figures to current dollars by valuing all dollars earned at today’s wage levels as compared with the wage level in effect at the time the income was earned. For example, assume the plaintiff works a 40-hour week year-around and that in 2000 he was paid $15 per hour and earned $31,200. In 2008, the wage is $20 per hour so earnings would be $41,600. He is doing the same work, working the same hours, implying that on a going forward basis, assuming all else constant, his earning capacity is $41,600 per year and not some lesser number since his year 2000 earnings valued at the current wage is also $41,600. This adjustment grows in relevance as one goes deeper into the past to extract earnings’ figures.

Remaining work life

The second building block is a quantification of the number of years of lost earning capacity. While it can be argued that persons have some earning capacity into their 80s or even 90s, even if it is small, convention often constrains work life between ages 62 to 70, though again there are many exceptions.

Economists have available several sets of tables that give measures of remaining work life. A recent study of retirement patterns in the Journal of Forensic Economics shows that there is substantial variation in the retirement age of both men and women around the mean retirement age. This variation may reflect the fact that for many people, the age of retirement is a voluntary choice and one which depends on personal factors such as family size and structure, need for income, financial worth, or the presence or absence of a good retirement plan.

Currently, the age requirement for full retirement benefits under Social Security is age 67 for those born after 1959. Many retirement plans have “normal” retirement ages of 65. On the other hand, police and firefighters work under a retirement plan that in certain circumstances, pays lifetime retirement benefits as early as age 50 which substantially replace final average earnings. In Los Angeles County, police and firefighters show average retirement ages in the 50s, opening up the potential for a second career of several more years.

The testimony of the plaintiff can be helpful in assisting the jury as to a reasonable retirement age. The plaintiff can testify to factors such as like or dislike of work, family needs, or whether he can afford to retire early.

From consideration of statistical and other tables or standards, and the testimony of the plaintiff, a retirement age can be selected that fits the evidence with the understanding that the choice of retirement date often has a voluntary component.

Wage growth rate

Wages typically increase over time due to inflation, general economy-wide productivity, reflecting the efficient interaction between labor, capital and technology; and individual productivity, such as experience raises, merit raises and promotions.

The wage increase rate reflected in many general statistics includes increases generated by both inflation and economy-wide productivity. The resulting wage growth depends on the years involved, treatment of fringe benefits, type of average such as mean or median wage statistics, and arithmetic versus geometric averages. Typically, the results economists arrive at differ within plus or minus a percentage point.

In determining wage growth, economists must be mindful of the long-run implications of their calculations. Generally, no one industry rises to the sky, and no one industry falls through the floor. Workers move into industries with higher earnings and exit those with lower earnings. These forces tend to moderate wage growth.

A review of the plaintiff’s wage growth history, pay rates, and contracts may provide some additional evidence on the quantification of the wage growth percentage to insert into the present value formula.

Discount rate

Economists derive their opinion on the discount rate from historical data, current market interest rates, and economic forecasts. There is no shortage of empirical data on this subject or debate on the appropriate financial instrument, length to maturity or historical period to use to derive the discount rate. In citing the following case, CACI 3904 provides assistance in selecting the appropriate discount rate:

Exact actuarial computation should result in a lump-sum, present-value award which if prudently invested will provide the beneficiaries with an investment return allowing them to regularly withdraw matching support money so that, by reinvesting the surplus earnings during the earlier years of the expected support period, they may maintain the anticipated future support level throughout the period and, upon the last withdrawal, have depleted both principal and interest.

(Canavin v. Pacific Southwest Airlines (1983) 148 Cal.App.3d 512, 521 [196 Cal.Rptr. 82].)

In previous jury instructions, present cash value has been defined as the “present sum of money, which together with the investment return thereon when invested so as to yield the highest return consistent with reasonable security, will pay the equivalent of lost future benefits at the time, in the amounts, and for the period that you find such future benefits would have been received.”

The key words here include “. . . highest return consistent with reasonable security. . .” and that such benefits should be paid “. . . at the time, in the amounts, and for the period that you find such future benefits would have been received.” Given this requirement, many economists use U.S. Government securities for meeting these conditions. U.S. Treasuries represent the largest class of securities in the world, and they offer excellent returns given the risk/return tradeoff. In good economic times, attorneys may point to the stock market as a source for the discount rate. However, as 2008 has reminded investors, there is tremendous risk and volatility associated with the stock market. Other rates such as those paid by corporate bonds, will be higher only due to risk, callability, and lack of liquidity.

Although most forensic economists base their discount rate on U.S. Treasuries, there is controversy about the appropriate maturity period of the bonds and the historical time period used. The longer the maturity period of the bond, the greater is the price volatility from future interest rate changes should bonds need to be sold before maturity. If a long-term bond has to be sold prior to maturity to assist in the earnings replacement or to keep up with changing inflationary expectations, the bond will be sold at a loss if interest rates have increased since the bond was purchased. The only way to assure that 100 percent of the principal is maintained is to hold the bond to maturity. The present-value formula assumes that none of the principal will be lost, and this is problematic when investing in long-term Treasuries.

Even if a long-term bond is held to maturity, if interest rates rise during the life of the bond due to inflationary increases, the bond holder cannot capture the higher interest rate. Economists often resolve concerns about long-term bonds by investing in shorter term Treasuries, since they mature more frequently, allowing the investor to more readily adjust to changing inflationary expectations. There is less inflationary risk and no risk of losing principal if the investor can hold the bond until maturity. The tradeoff for reduced price or inflationary risk is a lower rate of return. As the term of the bond shortens, the investment begins to converge on that outlined in the jury instructions. Economists acknowledge that the maturity period of the bond used to discount to present value is a matter of judgment, and often resolve the risk/return tradeoff by using shorter term instruments, say up to five years.

When measuring past interest rates, in addition to the maturity period of the bond, the economist can look to a variety of historical periods. Should the economist utilize a relatively short economic history or a longer economic history? The longer the period used, the greater the variety of economic events considered. By using a long economic history, one is not saying that these exact economic events are going to occur in the future, but that economic event types having similar magnitudes in terms of their effects on the supply and demand for money have a probability of occurring in the future. (This concept is discussed in Stocks, Bonds, Bills and Inflation published annually by Ibbotson Associates.) Historical data show that no one 10-year period has been a useful predictor of interest rates over the next 10 years. When projecting for a future period of only a few years, the economist may want to lock into the current yield curve, since the inflationary risk is less than in a longer term calculation. Also, if one has an income stream that is certain not to change in the future, he can lock in those payments using the current yield curve.

Present value of future medical expenses

If the wrongful injury results in ongoing future medical expenses for the plaintiff, the economist may be asked to calculate the present value of the future medical needs. The four building blocks used to calculate the present value of future medical care include:

• The cost of each future medical expense required due to the injury in today’s dollars;

• The period of time over which each medical expense will be needed;

• Percentage growth rate for each medical cost; and

• Discount rate or interest return on invested money.

Once these variables are determined, again the calculation of present value is a matter of arithmetic. Often the first two building blocks are outlined in a life-care plan prepared by a physician or registered nurse, and then the economist determines the growth and discount rates. In cases where there is some dispute regarding life expectancy, the economist can prepare annual summary tables, which provide present values of the life-care plan for multiple life expectancy options. The growth rates applied to future medical expenses often differ by category of care. For instance, professional medical services generally have a higher growth rate than medical care commodities. The calculation of the discount rate is the same as for the loss of earning capacity.

Summary

The goal of the above analyses has been to clarify the concept of present value and show how it changes depending on the quantification of the individual building blocks. As explained, economists may agree on the concept of present value, but they continue to debate how the four building blocks should be valued. This article does not attempt to resolve that debate, but to provide insight into how the initial present value awarded by the jury will serve to replace the stream of earnings that have been lost or provide for future medical expenses. This is a concept that is not easily understood when verbally articulated to the jury. The three dimensional charts included in this article visually demonstrate the concept of present value and may assist attorneys in explaining present value calculations to the jury. The appendix to this paper includes the same charts in a two-dimensional format, which measures the changing principal “balance” on the left axis and the interest income “cash inflow” and wage replacement “cash outflow” on the right axis.

Note to reader: Due to limitations of the software which generates this web page, we are unable to post the additional five charts provided by the author. However, the PDF does include the article complete with all illustrations.

Tamorah Hunt

Tamorah Hunt is an Economic Consultant with Formuzis, Pickersgill and Hunt, Inc. in Santa Ana, California. She received her MBA from the University of California, Irvine and her Ph.D. from Claremont Graduate School. She has over 23 years of experience as a forensic economist and has testified in several hundred cases throughout the state of California involving personal injury, wrongful death, wrongful termination and discrimination.

Copyright ©

2025

by the author.

For reprint permission, contact the publisher: Advocate Magazine