Uprooting the decision tree

Neuroscience meets mathematics in mediation: If they told you lawyers don’t need math, they lied!

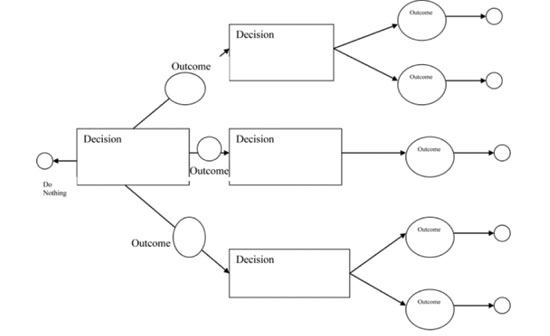

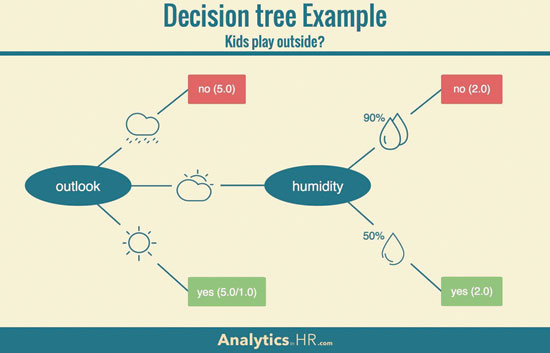

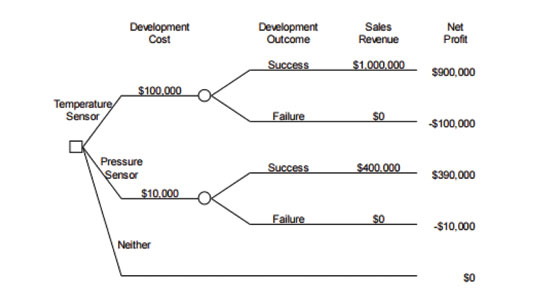

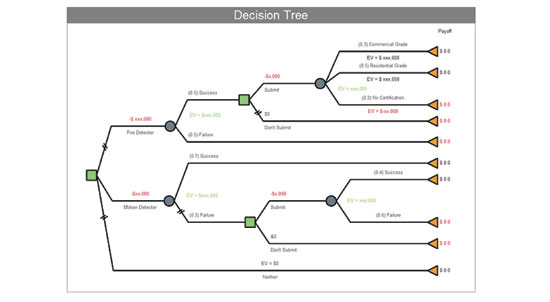

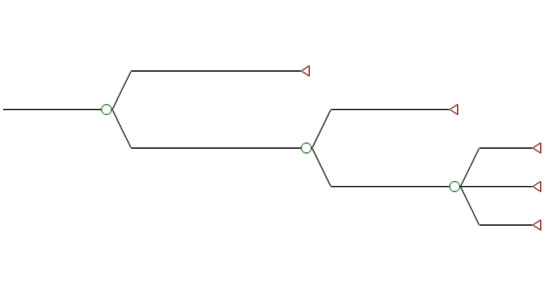

Decision tree analysis, also known as risk analysis, is a tree-like flow chart with nodes and branches that lists out each possible outcome of a decision, allows you to assign probabilities to the outcomes, and thus helps you to choose between several courses of action. Decision trees are predictive models that have had widespread use in the business world to help decision-makers to make choices in a logical way. A decision tree can be drawn in any number of ways, and the goal is to provide a visual representation of risks, rewards, and value of each decision.

A decision tree identifies the uncertainties that would follow from a range of decisions, analyzes the reasons for one uncertain result or another, assigns probabilities to the likelihood of each uncertainty occurring, assigns financial outcomes to each uncertainty, multiplies the probabilities by the potential outcomes, adjusts for costs, and compares the potential outcomes with alternative options facing the business. To enter a new market or expand in an existing market? To raise or lower prices? To cut back the number of employees or cut other expenses?

For example, see Figures 1-4 on pages 135-136:

(I was an early adopter of decision trees, and recall drawing one in law school to decide which guy to go out with one weekend.)

More and more attorneys are using decision tree analysis to evaluate lawsuits. To file a lawsuit or not? To file a counterclaim or not? To settle or take the risk of going to trial? A well-constructed decision tree produces a risk analysis that quantifies what a party is giving up if he or she settles a case.

It is the hope of this author that this article can explain how the benefits of traditional decision tree analysis can be integrated into the way people actually are motivated to make decisions, including our subconscious systematic errors (biases), leading to better decision-making in the context of deciding whether and how to settle a lawsuit.

What is decision tree analysis?

First, this is a simple summary of decision tree analysis. It is not the purpose of this article to teach decision tree analysis. There are books for that. The purpose here is rather to provide enough of a basic understanding of decision trees to see how they can be used in conjunction with psychological aspects of decision making to better evaluate cases for settlement.

Let’s start with a picture of a simple decision tree (see Figure 5 on page 137) that could be used to approach a risk-adjusted value of a lawsuit.

Each circle is a chance node, identifying an uncertainty, something that is not totally within your control. The branches that lead out from each chance node show the possible outcomes from the uncertainty.

For example, in this tree the first chance node could be “court grants summary judgment” and the branches would be “yes” and “no.” The “yes” fork leads to an end; the “no” fork leads to whatever the next chance node you wish to consider. The second chance node could be “jury finds liability,” and the third chance node could be “damages: high, medium, low.” That would obviously be a very summary and conclusionary decision tree.

Decision trees can have as few or as many chance nodes as you wish to consider. Decision tree experts will happily draw decision trees with dozens of nodes and branches showing each way in which a case could be influenced. Will motions in limine be granted? Will a key witness show up? Will the jury view the plaintiff as credible? Will a Daubert motion be granted, excluding your expert witness? Will a favorable jury instruction be given? Will the jury follow the jury instruction? Will the judge submit punitive damages to the jury? Will the jury grant punitive damages? If yes, what are the probabilities of a high, medium or low range?

For the rest of us who prefer simpler decision trees, the following steps will show you how to use a decision tree.

- Identify areas of significant uncertainty, preferably a small number of areas of most significant disagreement between the parties. Such areas could be the elements of a claim or whether the plaintiff will be believed by the jury. Apply numbers, probabilities, to each uncertainty.

- Set up a simple tree in an order that is logical in the context of your case. Chronological order is generally the most useful way to deal with multiple stacked probabilities, taking them in the order in which they will arise. For example, motion in limine; witness credibility; jury instruction. Alternatively, you could list the uncertainties in the order of importance, or in the order in which the elements of a cause of action must be proved, e.g., duty, breach, causation, damages.

- Set it up from the perspective of the party that has the burden on each item, usually the plaintiff, but shift to the defendant’s perspective if dealing with an issue on which the defendant has the burden. For example, plaintiff is a member of a protected class; plaintiff was qualified for her position; plaintiff suffered an adverse employment action; under circumstances giving rise to an inference of discrimination; defendant can show a legitimate reason for the action; plaintiff can show pretext.

- Place each significant uncertainty on the tree, moving from left to right, and annotate with words that describe the uncertainties. This will provide an excellent organizational tool by the time you finish this step.

- Fill in the probability numbers for each branch at each chance node. Think in terms of percentages, or if it is easier, think in terms of how many times out of ten would this be the result at that chance node. This step turns your words into numbers or ranges of numbers.

- Solve the tree. Multiply the percentages along each path to get the probability of that result. Assign financial outcomes to each path. The amount of damages to be awarded can be identified by ranges, such as $1 to $100,000 on one branch, $100,000 to $200,000 on another, and $200,000 – more on a third, with probability percentages assigned to each. At this stage you also need to factor in costs as appropriate: a plaintiff’s costs are subtracted from the expected outcome, and a defendant’s costs are added to its expected payout.

Why use decision tree analysis?

Decision tree analysis or risk analysis, call it what you will, involves time, analysis and math. For those attorneys who went to law school because they were assured there would not be math involved, this can be daunting. So, why do it?

Lawsuits are complicated, and people are not very good at thinking about multiple stacked probabilities. If I ask you what the probability is of calling a coin toss correctly, you know it’s 50 percent. If I ask you what the probability is of calling four coin tosses correctly, you may get it wrong. (Answer: it’s 50 percent x 50 percent x 50 percent x 50 percent = 6.25 percent.) If you tell me you have a 90 percent chance of defeating summary judgment, a 90 percent chance of proving duty, a 90 percent chance of proving breach of the duty, and a 90 percent chance of proving liability, you may assume you have somewhere around a 90 percent chance of prevailing. (Wrong: 90 percent x 90 percent x 90 percent x 90 percent = 66 percent.)

Decision trees force us to be explicit about the risks in litigation. As lawyers, we have our favorite phrases when evaluating a case to a client. “We have a fighting chance.” “Your claim is strong.” “That will never happen.” If you tell your client she has a “good chance of winning,” you may mean 40 percent; she may hear 75 percent. If you tell your client she will “definitely recover something,” she hears “definitely.” If you say she is almost sure to win, she hears 95 percent; you may mean 55 percent. By using decision tree analysis, we can quantify what we mean by these qualitative words, and prevent misunderstanding.

Decision tree analysis can be used in multiple ways, for example:

- To quantify in dollars, the key issues, risks, and uncertainties of the case for your client.

- To save face with the client if you previously gave a different estimate but you can now identify changed facts or law that have changed your estimate.

- To convince the other side to accept your proposed settlement.

- To convince a mediator of the validity of your settlement position.

- To identify the issues for trial preparation that need more focus.

In practice, however, when I first began using decision trees in a mediation, the result was a client who looked baffled because my analysis did not comport with her feelings about her case, and a lawyer who changed the subject. Eventually this led to two conclusions: (1) decision tree analysis is not something to be learned on the fly during a mediation, and (2) human beings are more impacted by psychology – our neural networks – than we are by math.

Rather than throw out decision tree analysis, we can uproot it, graft onto it common heuristics from the psychology of decision-making, and create a tool that will equip lawyers and clients to make better-informed judgments about how to use decision and risk analysis to assess litigation.

Using the uprooted decision tree

This alternative approach to using the principles of decision tree analysis to help frame settlement discussions uses the concepts but without drawing and solving a tree. (You may, if you wish, and if you work better with the tree visual.)

Start with the same first two steps as above: (1) identify the significant areas of uncertainty and assign outcome probabilities to each and (2) list or organize these in a logical or chronological order.

Limit your analysis to the two or three major areas of uncertainty, the areas in which the parties are the farthest apart. If the parties could bridge a gap in two or three areas, could you get close enough to settle the case? Set aside the smaller issues or you’ll get lost in the weeds. Take one issue at a time: if defendant’s big issue is a motion for summary judgment, plaintiff’s argument that he has a chance for huge damages is not responsive to that argument.

This analysis is useful when you find yourself being an agent of reality, counseling your client about settlement: what is the real probability of prevailing once you list the significant uncertainties and assign probabilities? Justify your answer. Why do you believe you have an 80 percent chance of winning? Are there reasons why you might be wrong? What are the unknowns?

Step (3) – quantify the best and worst case scenarios. Discuss damages, and assign odds of achieving a high, medium or low award. Combining the probabilities of each level of damages helps get a handle on the odds of prevailing at trial.

Step (4) – add in the role of the psychology of decision-making. Daniel Kahneman and Richard Thaler, two Nobel Prize winners in Economics for their work in behavioral economics, have written numerous excellent books and articles that discuss the bridge between the economic and psychological analyses of individual decision-making. By incorporating human behavior into decision tree models, we lawyers can improve our accuracy when evaluating whether to settle or to continue litigating.

Behavioral economists have identified dozens of heuristics, or cognitive illusions, that influence our decision-making. This article will focus on four of them and their role in shaping decision analysis for settling litigation.

The endowment effect

Richard Thaler, the recipient of the 2017 Nobel Prize in Economics, conducted an experiment in a large economics class at the University of Chicago, where he is a professor. He divided the class into thirds. He gave University of Chicago coffee mugs to one-third of the class and asked them what amount of money they would take to sell their mug (the Sellers). He asked another third of the class what was the most they would pay to buy the mug (the Buyers); and the final third of the class where they would be neutral between receiving cash or a mug (the Choosers).

The Buyers on average said they would pay $2.87 to buy a mug. The Choosers on average would take $3.12 in cash rather than the mug; at $3.11 they would take the mug. The Sellers wanted $7.12 to sell their cup. Why? Because the cup was theirs. What’s mine is special and valuable to me.

Your client owns his lawsuit. It is a personal vindication of his rights. To a rational person using decision tree analysis, the answer is obvious – the risk-adjusted value of the lawsuit is right there, in black and white. To the plaintiff, the lawsuit may be an embodiment of hopes, expectations, pain, vindication, years of emotions, and it’s all his. When something becomes personal, it becomes more valuable.

As a result, a defendant is either going to have to pay more to pry a lawsuit out of the hands of a plaintiff who has become closely attached to and possessive of his lawsuit, or someone, perhaps a neutral mediator, will have to recognize the need to distance the plaintiff from the lawsuit. As I often tell plaintiffs in mediation: “This is your lawsuit [drawing a short line on the white board] and this is your life [drawing an extended line that goes onward across the board]. Let’s finish up the lawsuit and get on with the rest of your life.”

Fairness

People will walk away from a deal that leaves them better off than no deal, i.e., a decision tree/risk analysis that shows that the offered settlement is better than the risk-adjusted value of continuing the lawsuit, if it violates their notion of fairness. In another well-known experiment that I use when I teach negotiation, take two people who do not know each other. Tell one, the “Divider,” that he has been given an amount of money that he has to divide between himself and a stranger. The stranger, the “Chooser,” will then accept the offer or reject it. If the offer is accepted, both will get to keep the money as divided. If the offer is rejected, neither gets anything.

In the experiment, the Divider is told he has been given $1,000. Sometimes I’ll instruct him to offer to divide it $20 to the Chooser, $980 to himself. Almost universally, the Chooser will turn it down. Most people will reject any offer until it reaches about 40 percent of the total. Yet that same Chooser would feel quite happy if he found a twenty-dollar bill lying on the sidewalk while out walking his dog. (I once found $20 while snorkeling in Hawaii and not only was I happy, but everyone I mentioned it to said how lucky I was to have such a great discovery!) But would I accept a $20 cut (gift) when the other guy got to keep $980? No way!

Once a party attaches a story about fairness to a lawsuit, that party will reject any offer that doesn’t seem “fair.” I encountered this in a mediation where, after explaining at length about the risk-adjusted value of the lawsuit, the amount of the settlement, the defendant’s ability to pay and the likelihood that the defendant would not be able to pay a large judgment, the plaintiff looked at me and said “What about me? I’m the one who got hurt. It’s not fair that he gets off just because he’s facing bankruptcy.”

In dealing with fairness concerns, having a decision tree that concretely explains why the numbers are what they are is one way of trying to push beyond a notion that something is not fair. Likewise, having researched verdicts or settlements in comparable cases can provide a measure of what is fair that adjusts the plaintiff’s focus.

Reactive devaluation

We are all familiar with this concept. My son may be perfectly willing to do something until he learns that his mother suggested it. After evaluating the case with your client, she tells you she’ll settle at $90,000 and not a penny less. The next day defense counsel sends you a letter offering to settle for $90,000. You call your client to tell her the good news (“The defendant just offered $90,000 to settle!), and your client is not happy. We attribute the value of an offer to the relationship we have with the person making the offer. Likewise, things that are offered are much less desirable once they’ve been offered. If something is too easy to get, there must be something wrong with it, or something I’m missing, or I’m being taken advantage of.

In this case, if you have some form of decision tree or risk analysis that is in writing and that confirms that the offered settlement is consistent with or better than your walkaway alternative, you can show that to your client with the reminder that the important question is which is better, the settlement or the status quo, not who put the settlement on the table.

The anchoring effect

This is the subconscious phenomenon of being influenced by a previously heard number. Buying a house for $500,000 seems high if the asking price was originally $450,000, but low if I’m told the asking price was lowered from $550,000. This phenomenon should encourage a party who has prepared a risk analysis and who is armed with a clear understanding of the value of his lawsuit to be willing to make the first offer or demand in a mediation, even if he was the party who had most recently communicated an offer or demand pre-mediation. By putting an anchor out there, as long as it is not too wildly outrageous, the party who starts the negotiation influences the expectations.

Further, if the other party has attempted to beat you to it with an anchoring offer that appears too low, counter with a number that you can anchor to your decision tree analysis, as a way of trying to dislodge their anchor.

Conclusion: We’re not purely rational

Clients (and lawyers, and all other people) are not purely rational economic beings. Because of limited rationality, we use and are influenced by simple psychological rules of thumb, heuristics, to help us make judgments. The use of these heuristics leads to systematic errors when we are asked to make complicated and emotional decisions.

Once we realize that there is a lot of subconscious psychological activity motivating our responses to settlement offers, our ability to work successfully with decision tree and risk analysis is increased since we are aware of all the different things that “matter.”

Barbara A. Reeves

Barbara A. Reeves, Esq., CEDS (Certified E-Discovery Specialist) is a highly regarded and well-respected mediator and arbitrator affiliated with JAMS. Before becoming a full-time neutral, Barbara Reeves was a litigator for more than 30 years, with the United States Department of Justice, Antitrust Division in Washington, D.C. and Los Angeles, a partner at national law firms and Associate General Counsel and Vice President for Southern California Edison and Edison International. Barbara Reeves is a Fellow of the Chartered Institute of Arbitrators and the College of Commercial Arbitrators, and a certified mediator with the International Mediation Institute. She received her J.D. cum laude from Harvard Law School.

Copyright ©

2025

by the author.

For reprint permission, contact the publisher: Advocate Magazine