Deposing insurance company personnel: lessons learned

Identifying the insurer’s PMK is crucial to your deposition strategy. So is fluidity in testimony, so let them talk

Most insurance companies don’t operate out of your backyard. They offer the promise of coverage from hundreds, if not thousands, of miles away. So, when the company breaks its promise and forces you to file suit on behalf of your client, how do you secure the trial testimony necessary to hold them accountable? Answer: videotaped depositions.

Depose the insurer’s PMK locally

Almost inevitably you will have to travel to depose insurance-company personnel in their home state. Subpoenas can’t compel out-of-state residents to appear in California. However, before booking your cross-country flight, consider this: the most important witness in your case (besides your own client) will likely be the insurance company’s designated witness – i.e., its person most knowledgeable – and that deposition can be taken in California. (Code Civ. Proc., § 2025.250)

Noticing person-most-knowledgeable depositions in California signals to the insurance company two things: (1) it doesn’t control this litigation; and (2) continuing to litigate with you in this case is going to be expensive. Each deponent will have to be flown out to California. If the company wants its in-house counsel to attend the depositions (which it will), they will have to be flown out as well. Not only does this strategy shift significant costs from the plaintiff to the insurance company, but it also allows you to take the deposition close to your home or office.

Not surprisingly, insurance companies don’t like this strategy. They will fight it. They may threaten to file a motion for protective order. Fine. Let them do it. They will lose. The law permits company designees to be deposed in California so that you can efficiently and economically litigate your case. This is a critical tool, especially for smaller cases. You can always obtain additional testimony later; but if you get everything you need out of the company witness, then you’ve saved yourself from an unnecessary cross-country trip.

Getting the right PMK

In bad-faith litigation we typically want the first deponent to be the most senior person at the insurance company who approved or authorized the denial. Often, the identity of this individual is not reflected in the claim file. Accordingly, a well-drafted PMK deposition notice can ensure that the insurer will be forced to designate the proper individual to testify on its behalf as to the company’s investigation and determination – the most senior person involved in the decision – as opposed to someone who has simply studied the claim file and will regurgitate its contents in deposition. Great care must go into drafting the notice, which can combine the PMK deposition along with other employees at the company you wish to depose. A typical deposition notice we have used reads like this:

TO EACH PARTY AND ITS ATTORNEYS OF RECORD IN THIS ACTION:

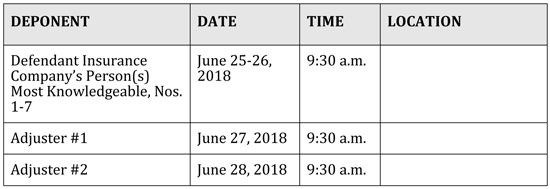

YOU ARE HEREBY NOTIFIED THAT, pursuant to CCP § 2025.230 et seq., Plaintiff will take the deposition of Defendant Insurance Company and its employees and/or agents in the following order and commencing on the dates and times listed below, and continuing from day to day until completed, as follows (see Figure 1):

The deponents identified as Person(s) Most Knowledgeable Nos. 1-6 are not natural persons, and Defendant Insurance Company is instructed to designate one or more persons to testify on its behalf as to the foregoing subjects:

DEFINITIONS

As used in this Notice, “MOST SENIOR” means the person with the highest corporate authority at Defendant Insurance Company with personal involvement in the CLAIM.

As used in this Notice, “CLAIM” means the claim of Plaintiff submitted to Defendant Insurance Company for defense and indemnity with respect to the underlying litigation titled, ___.

PMK CATEGORIES

(1) The thoughts, analysis, evaluation(s), rationale(s), investigation, research, review and reasoning of the MOST SENIOR person at Defendant Insurance Company who personally participated in the decision to deny the CLAIM for defense and indemnity (the term “participated” as used in this paragraph includes, without limitation, reviewed any documents, analyzed and/or discussed the matter with anyone, approved the denial or provided any information or input whatsoever into the decision).

(2) The thoughts, analysis, evaluation(s), rationale(s), investigation, research, review and reasoning of the MOST SENIOR person at Defendant Insurance Company personally involved with the CLAIM to explain all actions taken by the Company with respect to the CLAIM.

(3) The thoughts, analysis, evaluation(s), rationale(s), investigation, research, review and reasoning of the MOST SENIOR person at Defendant Insurance Company personally involved with the CLAIM to explain all determinations made by the Company with respect to the CLAIM, including the determination that the insured was not entitled to defense or indemnity.

(4) The existence of and content of any writing, files, procedures, claims-handling procedures, guidelines, claims manuals, or documents of any kind including any material contained in any computer which existed at any time from 2015 to the present applicable to the CLAIM.

(5) Authentication and contents of underwriting file relating to Policy no. ___;

(6) The loss reserves established by Defendant Insurance Company at any time in connection with the CLAIM.

(7) Authentication and contents of the claim file maintained by, or on behalf of Defendant Insurance Company in connection with the CLAIM.

Pursuant to CCP § 2025.230, Defendant Insurance Company is obligated to designate and produce at its deposition those of its officers, directors, managing agents, employees or agents who are most qualified to testify on its behalf as to the foregoing matters to the extent of any information known or reasonably available to Defendant Insurance Company.

YOU ARE FURTHER NOTIFIED THAT the deponents are required to produce the ORIGINALS of the documents identified in the attached Exhibit A at said deposition.

The deposing party intends to have the proceedings recorded stenographically, through the instant visual display of the testimony, and by videotape for purposes of trial in this matter.

Get prior depositions

If you are taking insurance company depositions, chances are you are not the first attorney to depose that company or that particular witness. Many company designees are career witnesses. They have been deposed 10, 20, 30 or even 50 times. Do not hesitate to reach out to fellow counsel who have questioned your deponent. They may have insights regarding him or her, and from our experience, most are willing to share information. Read prior deposition transcripts. Read the declarations that your witness submitted under oath in other litigation. Read their Facebook, LinkedIn and Twitter accounts.

Knowing your witness is essential to your deposition. The best depositions are like a dance with someone familiar (albeit adversarial), not an awkward first date. Knowing your witness may also help you develop new lines of questioning; guide the sequence in which you ask your questions; and help ensure that you are using proper tone throughout the deposition.

More seasoned witnesses may require aggressive questioning, while inexperienced witnesses may require a softer approach. For example, we recently deposed a retired hand surgeon in a bad-faith disability case. We knew from prior depositions that he was stubborn and arrogant. We wanted the jurors to see these traits and think, “I would never want someone like that reviewing my claim.” So, we started the deposition with a question we knew he would take offense to:

Q: Are you a retired hand surgeon?

A: I’m a – I’ve retired from surgery doing hands.

Q: So that’s, yes, you’re a retired hand surgeon?

A: Once you’re a surgeon, you’re always a surgeon.

Q: Are you still a surgeon?

A: I’m still a surgeon.

Q: When was the last time you performed surgery?

A: Not since I left the Navy in 1997.

This set the stage for the remainder of the deposition. The surgeon’s responses were retaliatory and defensive. He avoided answering simple questions. There was no accountability. He was a horrible witness for the insurance company (and a great witness for us). Knowing how this witness would respond to our questioning was critical to obtaining his best testimony.

Moreover, homework needs to be done with respect to what needs to be accomplished in the deposition for your case. Insurance company depositions should be approached from the standpoint of answering this question: what testimony or admissions do I need to obtain from the witness in order to overcome the insurer’s inevitable motion for summary judgment on bad faith and punitive damages? You know the insurer will likely argue that its denial was the product of a so-called “genuine dispute” as to coverage, or that its handling was, at most, sloppy. What key admissions do you want to obtain to overcome those arguments? The answer will form the foundation of your deposition preparation and the structure of the deposition itself.

Let the testimony flow

Each deposition is different. As much as we want to dictate where the deposition will go, we can’t. The answers to our questions often cannot be predicted and we must adjust. Depositions cannot be approached from a fixed position. Fluidity is an absolute necessity. That being said, here are a few of the helpful lessons we have learned over the years when taking insurance company depositions:

- Keep it interesting. Taking depositions of the same insurance company and the same insurance adjusters on the same issues can be tedious. It can seem repetitive. It can feel robotic. But if you aren’t excited about the deposition, how can your jury get excited about it? This is particularly important since video is often our only medium for communicating testimony to the jury. The jury won’t see you asking the questions, but they should feel the importance of each question when you ask it in an emotionally congruent tone.

- Use your questions to frame the issues. You know your case. But the jury doesn’t. This is likely the first time that they have heard the concept of bad faith. So, simplify the issues by starting with the question, “Now I want to talk about [insert topic] . . .” Not only does this clarify what you are talking about for the jury, but it breaks down the testimony into digestible chunks for trial which you can plug and play. Even if the lines get blurred between topics (which they will), it is still helpful to have a framework for your questions.

- Keep the witness guessing. Many attorneys begin their depositions with extensive background questions. While this may be important in certain cases, it also allows the witness to settle in and gain confidence. Instead, try minimizing background questions and jump straight to the key issues in the case before the witness gets comfortable. This keeps the witness off-balance, which makes it more likely that you will get an honest response to your questions instead of the canned response that has been drilled into your witness during prep sessions with counsel.

- Don’t shy away from a witness’s nonresponsive answer to a question. Company witnesses often don’t want to answer questions. They will repeat a generic response like, “We considered all available information when deciding the claim.” Don’t be discouraged. Ask the question over and over again. Sometimes the witness will break form and answer the question. But even if they don’t, the absurdity of their refusal to answer your question will become obvious. A witness’s refusal to answer a question can often be more damaging than simply providing an honest answer to the question.

- End the deposition with a compelling question. This can be as simple as, “Do you have any criticisms of the company?” (The answer to which is almost always an unequivocal, “No.”) Other questions include a series of, “Isn’t it true that the company failed to do [x]?”; “Isn’t it true that the company failed to do [y]?”; “Isn’t it true that the company failed to do [z]?” This will provide the jury with a short summary that highlights your witness’s best testimony. If the witness attempts to explain the failure, it will merely serve as another example of the company’s refusal to take responsibility for its misconduct.

Deposition testimony is a fundamental part of our bad-faith cases. It is another opportunity to tell a story to the jury regarding the insurance company’s bad-faith conduct. The better the story, the better the chances are that the jury will hold the company accountable and you will achieve a fair and just result for your client.

Terry Coleman

Terry Coleman has been a partner with Pillsbury & Coleman, LLP (formerly, Pillsbury & Levinson), since 1999, specializing in the representation of policyholders in insurance bad faith and insurance coverage matters. He is a past president of the San Francisco Trial Lawyers Association and a Fellow of the American College of Coverage and Extracontractual Counsel. Mr. Coleman also served as chair of the Insurance Section of the Association of Trial Lawyers of America (now AAJ). www.pillsburycoleman.com.

Ryan Opgenorth

Ryan Opgenorth is a senior associate at Pillsbury & Coleman LLP. He exclusively represents policyholders in bad-faith litigation against their insurance carriers in order to hold companies accountable for their misconduct. He has been a Northern California Super Lawyers Rising Star each year since 2013. He can be reached at ropgenorth@pillsburycoleman.com.

Copyright ©

2025

by the author.

For reprint permission, contact the publisher: Advocate Magazine