Independent medical providers: To lien, or not to lien?

Avoiding the ethical and legal pitfalls of independent medical-provider liens

Injured clients regularly obtain medical services on a lien basis to treat their injuries. Such services can range from those of physicians and surgeons to MRI/imaging providers to psychological services or chiropractic care. Yet independent medical provider liens contain a plethora of ethical and legal traps for the unwary attorney. This article discusses the ethical and legal ramifications of independent medical provider liens for the attorney and offers practical considerations to help answer the question of whether a client should treat on a lien.

Ethical duties

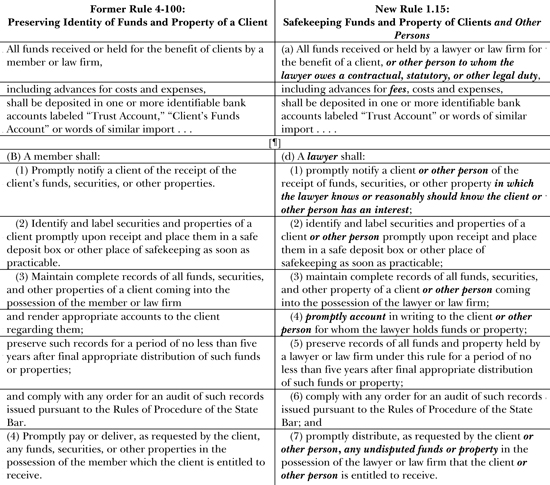

Recent changes to Rule 1.15 (former Rule 4-100) of the California Rules of Professional Conduct describe an attorney’s ethical duties to protect the funds or property of certain third persons, and not just a client. An attorney is now ethically bound to safeguard the funds or property of third persons “to whom the lawyer owes a contractual, statutory, or other legal duty.” Comparing the former rule to the select portions of the new rule highlights these differences (amended language in new rule emphasized):

(See table.)

Although Rule 1.15 may appear to expand an attorney’s duties, the new rule merely better articulates an attorney’s existing duties under California common law. The rules committee intentionally suggested that a lawyer may need to research the common law to comply with her ethical obligations:

Whether a lawyer owes a contractual, statutory or other legal duty under paragraph (a) to hold funds on behalf of a person other than a client in situations where client funds are subject to a third-party lien will depend on the relationship between the lawyer and the third-party, whether the lawyer has assumed a contractual obligation to the third person and whether the lawyer has an independent obligation to honor the lien under a statute or other law. In certain circumstances, a lawyer may be civilly liable when the lawyer has notice of a lien and disburses funds in contravention of the lien. (See Kaiser Foundation Health Plan, Inc. v. Aguiluz (1996) 47 Cal.App.4th 302.) . . .

(Comment No. 1 to Cal. R. Prof. Cond., Rule 1.15 [emphasis added].)

Note, however, a lawyer’s ethical duty to third-party lienholders is independent of any civil liability. Comment No. 1 goes on to state,

. . . However, civil liability by itself does not establish a violation of this rule. (Compare Johnstone v. State Bar of California (1966) 64 Cal.2d 153, 155-156 [“‘When an attorney assumes a fiduciary relationship and violates his duty in a manner that would justify disciplinary action if the relationship had been that of attorney and client, he may properly be disciplined for his misconduct.’”] with Crooks v. State Bar (1970) 3 Cal.3d 346, 358 [lawyer who agrees to act as escrow or stakeholder for a client and a third-party owes a duty to the nonclient with regard to held funds].)

Thus, civil liability for disbursing funds without considering an independent medical-provider’s lien is not a per se ethical violation of Rule 1.15. Of course, the more prudent approach is to avoid getting into an ethical entanglement in the first place.

The lawyer and the treating provider

Returning to Comment No. 1 of Rule 1.15, in the context of an independent medical-provider lien, “the relationship between the lawyer and the third party” is unlikely to pose an issue unless some fiduciary or other special relationship exists between the lawyer and the treating provider.

As far as “contractual obligations” are concerned, both ethical and legal duties arise from signing a lien on behalf of or in addition to a client. By signing a lien, a lawyer is clearly required to satisfy the lien before distributing the settlement proceeds to the client. (See, e.g., Matter of Riley, 3 Cal. State Bar. Ct. Rptr. 91, 113-114 (Rev. Dept. 1994) [ethical violation for willful failure to pay contractual lien found simply by the fact of non-payment].)

The ambiguity comes from contractual liens to which a lawyer is not a party: a lawyer’s ethical “independent obligation to honor the lien” and civil liability can arise under an equitable lien theory supporting a number of legal causes of action, including, inter alia, conversion, intentional or negligent interference with contract, or money had and received. Thus, understanding the common law on equitable liens is crucial.

The development of the common law regarding equitable liens

Section 2872 of the Civil Code defines an express lien as follows: “A lien is a charge imposed in some mode other than by a transfer in trust upon specific property by which it is made security for the performance of an act. (Civ. Code, § 2872.)

An equitable lien, however, is more broadly defined as “a right to subject property not in the possession of the lienor to the payment of a debt as a charge against that property.” (Farmers Ins. Exchange v. Zerin (1997) 53 Cal.App.4th 445, 453 (Zerin).) Such liens are often based on the doctrines of estoppel or unjust enrichment, and may arise under contract or “out of general considerations of right and justice as applied to the relations of the parties and the circumstances of their dealings.” (Ibid. [citing 1 Jones, The Law of Liens (3d ed. 1914) § 27, pp. 24-25].) In sum, “equitable liens are favored to do justice and prevent unfair results.” (Estate of Henshaw (1945) 68 Cal.App.2d 627, 636.)

“[E]quitable liens arising by contract are as various as the contracts parties may make, and the question whether a lien has been created under particular circumstances depends upon the facts of the case.” (Id. at p. 454.) Thus, no hard and fast rule dictates when an equitable lien may arise, and the analysis is inherently fact-specific.

The common law initially seemed to indicate that mere notice of a third party’s interest in funds a lawyer held in trust gave rise to a duty of the lawyer to safeguard the property. Yet as the law developed, various appellate districts came to differing conclusions on attorney liability for failure to safeguard the property of third-party beneficiaries. Courts found, or not, equitable liens or their equivalent sufficient to impose liability on a lawyer who held funds in trust for a client.

The notice-based line of cases arose from the Second District’s opinion in Miller v. Rau (1963) 216 Cal.App.2d 68. Miller imposed a “positive duty” on attorney Rau to hold plaintiff Miller’s claimed interest in the net profits from the sale of several airplanes in trust. (Id. at pp. 74, 76.) Although Rau had notice of Miller’s interest in the net profits, Rau did not notify Miller or Miller’s attorneys of his receipt of the funds. (Id. at p. 74.) Instead of holding the disputed amount in trust or interpleading the funds, Rau disbursed them per his client’s directions. (Id, at pp. 75, 76.) In upholding Rau’s liability to Miller for conversion, the Second District determined,

There was nothing in the defendant’s status as attorney for [his client] . . . which made it his duty to pay to his client money which he knew . . . belonged to plaintiff. [Citations.] The defendant had complete control over the money. It was his duty to hold for the plaintiff so much of the proceeds . . . as represented the plaintiff’s known interest in it.

(Id. at p. 76 [quoting General Exchange Ins. Corp. v. Driscoll (1944) 315 Mass. 360 [52 N.E. 2d 970, 973]].)

In McCafferty v. Gilbank (1967) 249 Cal.App.2d 569, 572 the Second District explicitly found an attorney liable for conversion under an equitable lien theory. The defendant attorney represented a personal injury victim, Swiger. While the personal injury litigation was pending, Swiger’s ex-wife and plaintiff obtained a judgment for child support against Swiger. (Ibid.) The defendant negotiated a settlement of the child support judgment with the plaintiff’s attorneys. The plaintiff eventually agreed to accept one-half of Swiger’s recovery as satisfaction of the prior judgment, and a settlement agreement was signed. (Id. at pp. 572-573.) Yet the defendant endorsed the settlement checks and disbursed the funds without paying the plaintiff. (Id. at p. 574.)

McCafferty reversed nonsuit against the plaintiff, finding that an equitable lien arose from a negotiated settlement agreement. (Id. at pp. 575-576.) Relying on Miller, McCafferty held the equitable lien was the plaintiff’s property interest supporting the defendant’s liability for conversion. (Id. at p. 576.)

Several years later, however, the Fourth Appellate District reached a different result in Brian v. Christensen (1973) 35 Cal.App.3d 377. Brian refused to read into the Medi-Cal lien statute a duty of attorney Christensen – as opposed to his client – to provide notice of the litigation and its settlement to the Department of Health Services. (Id. at p. 381.) The appellate court determined that without such a duty, Christensen could not be liable to reimburse the Department for the Medi-Cal benefits his client received. (Id. at p. 382.) Brian impliedly found that an equitable lien did not attach in the face of controlling statutory provisions. (See Id. at pp. 382-383 [dissenting opinion that the allegations showed an equitable lien should have attached, which would then state a cause of action against the lawyer].)

When only the client signs reimbursement agreement

The seeming conflict between Miller and its progeny and Brian was not addressed for more than twenty years, until First Appellate District’s opinion in Kaiser Foundation Health Plan v. Aguiluz (1996) 47 Cal.App.4th 302, 303-304 (Aguiluz) [overruled on other grounds as stated in Snukal v. Flightways Manufacturing, Inc. (2000) 23 Cal.4th 754, 775, fn. 6]. In upholding judgment for Kaiser, Aguiluz found Brian did not abrogate Miller and its General Exchange rule. (Id. at p. 305.)

In Aguiluz, the injured client, Frez, treated through Kaiser and acknowledged Kaiser was entitled to reimbursement for the amount Kaiser paid. (Id. at p. 304.) In the acknowledgement, Frez specifically directed his attorney (Aguiluz) to reimburse Kaiser for its expenses paid on Frez’s behalf from any third-party recovery. Only Frez signed the reimbursement agreement with Kaiser. (See Id. at p. 307.) Although Aguiluz attempted to negotiate Kaiser’s lien after settlement, negotiations failed and Aguiluz made no attempt to protect Kaiser’s claim. (Id. at p. 304.) Kaiser sued, and judgment was entered for Kaiser in the full amount claimed against Aguiluz. (Ibid.)

Reviewing numerous opinions following Miller and its General Exchange rule, Aguiluz found no conflict between Miller and Brian, since the Department failed to plead an equitable lien attached in Brian. (Id. at pp. 307-308.) With the Miller rule intact, the First District held that Aguiluz’s notice of the reimbursement agreement and disbursement of the funds after negotiations to reduce the amount failed, was sufficient to create an equitable lien enforceable against him. (Id. at p. 307.) Notably, Aguiluz did not challenge that an equitable lien was created – just whether it could be enforced against him. (Id. at p. 305, fn. 1.)

Conversion as the cause of action: Zerin

The Third Appellate District weighed in on equitable liens as the property interest in a cause of action for conversion, among others, in Zerin, supra, 53 Cal.App.4th 445. In this seminal case, Farmers Insurance sued only defendant Zerin, the attorney who represented Farmers’ insureds against third-party tortfeasors, to recover medical benefits Farmers paid to its insureds. (Id. at p. 450.) Returning to fundamental legal principles, Zerin began its analysis with whether an equitable lien was created at all. Under similar facts as Aguiluz, Zerin came to the opposite conclusion and ultimately found the defendant attorney’s demurrer was properly sustained. (Ibid.)

To prevail on a claim for conversion, the party must be “entitled to immediate possession at the time of conversion.” (Id. at p. 452 [citing Bastanchury v. Times-Mirror Co. (1945) 68 Cal.App.2d 217, 236] [original italics, bold added].) Zerin emphasized that “a mere contractual right of payment, without more, will not suffice.” (Id. at p. 452.) Therefore, a claim for breach of contract, as opposed to a property interest such as a title or lien, is inadequate to prove conversion. (Ibid. [citing Imperial Valley L. Co. v. Globe G. & M. Co. (1921) 187 Cal. 352, 353-354].)

Having established a valid property interest is required to prevail on a conversion cause of action, Zerin next analyzed when such a property interest in the form of an equitable lien arises. Zerin began with three basic principles:

• “A promise to pay a debt out of a particular fund, without more, will not create an equitable lien on that fund.” (Id. at p. 454.)

• “A promise to hold property in trust for another, standing alone, will not create an equitable interest in that property.” (Ibid.)

• “‘A promise that certain goods shall be held in trust for the benefit of another, and that the proceeds shall be paid to him, does not amount to an equitable assignment of the goods or specific lien upon them; for in such case the owner retains control of the goods, and may appropriate them or their proceeds to the payment of other creditors, and the holder of such promise cannot follow the goods any more than he could follow their proceeds.’ (1 Jones, The Law of Liens, op. cit. supra, § 51, at p. 51.)” (Id., at p. 455.)

Zerin recognized, however, “even a mere promise to pay from a specific fund may suffice to create an equitable lien if considerations of detrimental reliance or unjust enrichment are implicated.” (Id. at p. 455.)

Applying those principles to the facts before it, Zerin found the Farmers insurance policy language did not give rise to an equitable lien. Farmers did not show detrimental reliance on receiving reimbursement from a particular fund, since the policy language obligated Farmers to pay medical benefits for any covered injury independent of any right of reimbursement. (Id. at p. 456.) Nor did Farmers forgo other rights or remedies based on the strength of any promises by Zerin to reimburse Farmers from the settlement. (Ibid.) Moreover, Zerin noted that Farmers could not recover the medical benefits paid simply by giving notice to its insureds’ attorney, implicitly disagreeing with the Miller notice rule. (Id. at pp. 456-457.)

Following Zerin, the Fourth Appellate District also dug deep into the equitable lien analysis in Farmers Ins. Exchange v. Smith (1999) 71 Cal.App.4th 660 (Smith). While Zerin was more pithy, Smith took a distinctly colorful approach from its very opening:

The central question in this case is whether an insurer can, in effect, press-gang a policyholder’s personal injury attorney into service as a collection agent when the policyholder receives medical payments from the insurer and then later recovers from a third party tortfeasor. As one might guess from the verb “pressgang,” the answer is no.

(Smith, supra, 71 Cal.App.4th at p. 662.)

Faced with essentially identical facts as Aguiluz and Zerin, Smith underscored a few basic realities specific to insurance reimbursement claims:

• “An insurer does not detrimentally rely on anything when it makes first party medical payments to one of its policyholders as a result of an auto accident. It is just doing what it contracted to do.” (Ibid.)

• “[A] policyholder’s attorney [not] unjustly enriched when he or she remits money to the client that the client is entitled to under the attorney-client agreement. The contractual relationship created by an insurance policy is between the insurer and the insured, not the insured’s attorney.” (Ibid.)

• “The simple fact that an insurance policy obligates the policyholder to reimburse the insurer for first party medical payments later recovered from a third party does not create an independent obligation on the part of the insured’s attorney to “insure” – for want of a better word – that the client lives up to his or her obligation. The attorney is not the client’s keeper.” (Ibid.)

Although the facts of Smith, Aguiluz, and Zerin dealt with insurance, or, pre-existing contracts for benefits, Zerin remains one of the seminal cases on equitable liens. The basic principle articulated in Zerin – namely, that mere promises, without other equitable considerations such as detrimental reliance or unjust enrichment, are insufficient to create an equitable lien or interest – is still good law. Further, in the twenty years since Smith was decided, no other published opinion has analyzed the Miller rule to this extent.

Remember, however, the ethics rules committee relied on Aguiluz in the comment to demonstrate potential attorney liability. Further, both Miller and McCafferty were decided in the Second Appellate District. Until the California Supreme Court steps in, this split among the Districts will continue.

Two general fact patterns

With this understanding, two general fact patterns emerge concerning independent medical provider liens:

(1) If a lawyer signs a lien agreement with an independent medical provider, the lawyer has both legal and ethical duties to protect the medical lienholder’s interest under the contractual lien. If a conflict between the client and the lienholder cannot be resolved, the lawyer should interplead the funds to fulfill her ethical obligations under Rule 1.15 and protect herself from legal liability.

(2) If only the client signs a lien agreement with an independent medical provider, a lawyer may have legal and/or ethical obligations to protect the medical lienholder’s interest. Whether such a duty exists or is created is a highly fact-specific analysis that must focus on detrimental reliance and possibly other equitable considerations. Is there a pre-existing relationship between the attorney and the provider? For example, does the lawyer regularly send clients to treat with this particular chiropractor? What promises did the lawyer make, if any, before or during negotiating the lien? Did the treating physician forgo other rights or remedies in reliance on the attorney’s representations?

What if, however, a provider sells its liens to a factoring company? Or sells the practice? While a more complete analysis of this twist is beyond the scope of this article, finding that answer begins with looking at the lien contract.

The case law unfortunately does not articulate a bright-line rule to help an attorney determine her legal and/or ethical obligations to protect an independent lienholder’s interest when the lawyer is not a contracting party to the lien. But if you are ever confronted with this issue, the three must-read cases are: (1) McCafferty as the closest published fact pattern on an attorney’s legal obligation to protect a third party’s interests under an equitable lien theory – and yes, the lawyer was liable; (2) Zerin for its black letter analysis of the creation of equitable liens; and (3) Smith for its thoughtful analysis on the fundamentals, delightfully delivered.

To treat on a lien, or not treat on a lien?

The first step in any decision to have a client treat on a lien is explaining liens and their ramifications to the client. A second, and arguably equally important consideration is how treating on a lien will affect medical special damages. Treating on a lien can increase the dollar amount of medical damages after past such damages were limited in Hanif v. Housing Authority (1988) 200 Cal.App.3d 635 (limiting past medical damages to the amounts negotiated and paid through Medi-Cal] and Howell v. Hamilton Meats & Provisions, Inc. (2011) 52 Cal.4th 541, 566 [limiting past medical damages to the amounts negotiated and paid through insurance.) (See Pebley v. Santa Clara Organics, LLC (2018) 22 Cal.App.5th 1266, 1273-1276.)

Yet a word of caution: Pebley accentuated the plaintiff’s right to choose to seek the best medical possible care, even if that meant going outside of his HMO insurance plan. (Id. at p. 1277.) The Second District recounted the seriousness of Pebley’s injuries and the life-altering consequences of not obtaining the best possible care, lending objective legitimacy to Pebley’s decision to seek care outside of Kaiser, on a cash (lien) basis. (Ibid.; compare Id. at p. 1270 [noting defendant’s argument that the plaintiff’s treatment on a lien basis was nothing more than a ploy by crafty plaintiffs’ lawyers to “sidestep the insurance company and the impact of Howell, Corenbaum and Obamacare” and “increase the ‘settlement value’ of personal injury cases].)

Thus, if the health-care provider accepts your client’s health insurance, do not attempt to obtain that treatment on a lien. Treating with a health-care provider on a lien basis, when that same health-care provider accepts your client’s health insurance, eviscerates the objective legitimacy of the plaintiff’s choice in care. Choosing the best possible care (the treating provider), but at the most expensive option (lien), only bolsters the argument that treating on a lien is naught but a ruse to get more money from the defense.

Nor should providers attempt to convert covered care to a lien basis. Part of the provider’s contract with the insurance company is that the provider will accept the plan’s members for care and treatment – whether the provider is paid under a bundled model (payment for a package of health care services), fee-for-service (payment based on services provided at a pre-negotiated rate), capitation (the insurance company pays the provider a flat fee per plan member, per month, no matter how many patients are actually seen), or some other payment model. Explain the danger of recovery being limited to only the plan’s negotiated rate and converting covered care to a lien basis will become much less attractive.

While the benefits of a client obtaining medical care on a lien basis are many, a prudent lawyer must be aware of the legal and ethical pitfalls of such care. Understanding an attorney’s obligations under new Rule 1.15, which better describes the standards already imposed under the common law, is crucial.

Alyssa Kim Schabloski

Alyssa Kim Schabloski is a trial attorney with Gladius Law, APC. A plaintiff’s lawyer for her entire legal career, she practices in employment law, medical malpractice, and catastrophic personal injury. Alyssa graduated from Barnard College and obtained her JD and MPH from the UCLA Schools of Law and Public Health. She served as 2020 President of the Los Angeles Trial Lawyers’ Charities (LATLC) and President of the Cowboy Lawyers Association from 2019-2021. She is a member of the CAALA Board of Governors. Alyssa is admitted to practice in California, Arizona, and New York.

Copyright ©

2025

by the author.

For reprint permission, contact the publisher: Advocate Magazine